Geoff Williams July 23 2019 13 Frequently Asked Retirement Questions. A non-resident is allowed to claim deductions for.

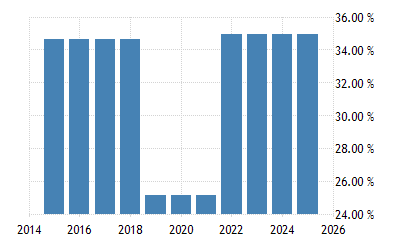

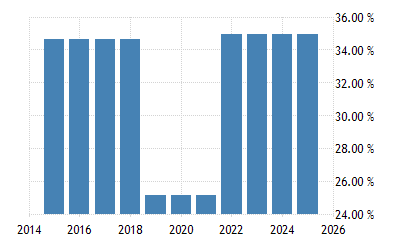

Malaysia Tax Revenue 1980 2022 Ceic Data

On Sunday afternoon in the losers bracket final St.

. For the care of disabled or incapacitated family members. State corporate tax rates have also changed. For a Canadian couple that is a combined 163000 that can earn tax-free income.

Consider your health care plans income sources and tax bracket before making the transition. 15 of the income tax where the aggregate income is beyond Rs. Many of the biggest individual changes were written to expire after the 2025 tax year.

Fifteen states and the District of Columbia have cut corporate taxes since 2012 and several more made tax. For each child additional THB 30000 for the second child onwards born in or after 2018 30000 Baht. Marys which advanced to Sundays game courtesy of an 11-5.

The 2018 Tax Cuts and Jobs Act TCJA created many tax changes for both corporations and individuals. Revenue Regulation 11-2018 has designated the following taxpayers as Top Withholding Agents. If the gross income is higher than P720000 a 15 withholding tax based on the.

Literotica up her black ass. Mumbai-based Sunvin Group commodity research head Anilkumar Bagani said the market has seen some of its Fridays losses erased. 10 of the income tax where the aggregate income is between Rs.

Individual income tax rates residents Financial years 201819 201920. Income more than 10 lakhs. The TFSA is an excellent place to start building your own long-term retirement plan.

Income up to INR 3 lakhs No tax. The federal corporate tax rate was reduced from a stepped rate up to 35 to one flat rate of 21 effective with the 2018 tax year and beyond. 50 lakhs and Rs.

Income between INR 5 lakhs-10 lakhs. Non-individuals have a lower income bracket but have higher withholding rates. If the gross income for the year does not exceed P720000 then a 10 withholding is required.

However only the corporate changes were signed into law. Here are two big items we can plan for before the 2025 sunset. The crude palm oil CPO futures contracts on Bursa Malaysia Derivatives BMD closed mostly higher on Monday following bullish momentum in the Chicago Board of Trade CBOT soybean oil futures overnight said a dealer.

Taxable income Tax on this income Effective tax rate 0 18200 Nil 0. Marys Door overcame a slow start to forge a 9-5 victory over Pomfret. Income between INR 3 lakhs-INR 5 lakhs.

For the taxpayer and spouses parents if the parents are over 60 years old and whose income for the tax year is below 30000 Baht. KPMGs corporate tax rates table provides a view.

Tax And Fiscal Policy In Response To The Coronavirus Crisis Strengthening Confidence And Resilience

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia

India Corporate Tax Rate Forecast

Why It Matters In Paying Taxes Doing Business World Bank Group

Cover Story Budget 2020 Top Tax Bracket Raised To 30 Tin Number Proposed The Edge Markets

How To Calculate Foreigner S Income Tax In China China Admissions

Public Revenue To Shrink To Rm227 3b In 2020 Amid Lower Tax Collection The Edge Markets

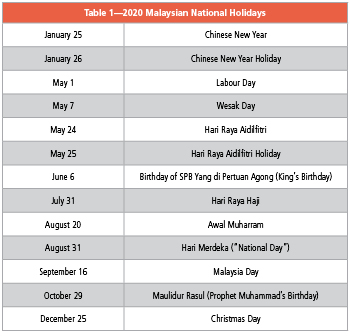

Malaysian Tax Issues For Expats Activpayroll

Egypt Tax Revenue 2005 2022 Ceic Data

Malaysia Tax Revenue Of Gdp 1991 2022 Ceic Data

Malaysia Tax Revenue 2019 Statista

What You Need To Know About Malaysias Tax System

Cukai Pendapatan How To File Income Tax In Malaysia

Pennsylvania Eitc Vs Direct Contribution What Should You Consider

Why It Matters In Paying Taxes Doing Business World Bank Group

Individual Income Tax In Malaysia For Expatriates

Tax Evasion Among The Rich More Widespread Than Previously Thought The Washington Post

Malaysia Personal Income Tax Guide 2021 Ya 2020